Kathmandu: Viber has launched a new chatbot payment, a key feature of existing messaging systems, to mark a decade of service launch. Viber has announced that it is now expanding its services to Fintech.

Viber users will now be able to use the platform to purchase goods and pay for services, using Google Payments or a local mobile wallet.

This intiative has set an important milestone by promoting Viber ahead of messaging. The service will be launched in Ukraine and Viber plans to expand to other markets by 2021. To this end, the company has developed an end-to-end platform that meets the needs of all its users, outlined by excellent privacy security standards.

At the beginning of 2017, 64 percent of the youth had expressed their interest in P-to-P transfer in messaging apps. Due to the pandemic, this number has increased even more rapidly. Realizing this need, Viber has moved towards FinTech Digital Payments by expanding its services towards utilities and emphasizing on the protection of user privacy.

In Nepal, Viber has partnered with e-Sewa, the country’s largest e-wallet transfer platform, to bring its own e-service community and festive sticker packs, and Viber will soon have a special partnership with e-Sewa. After this partnership, users will be able to top up mobile and transfer peer-to-peer money.

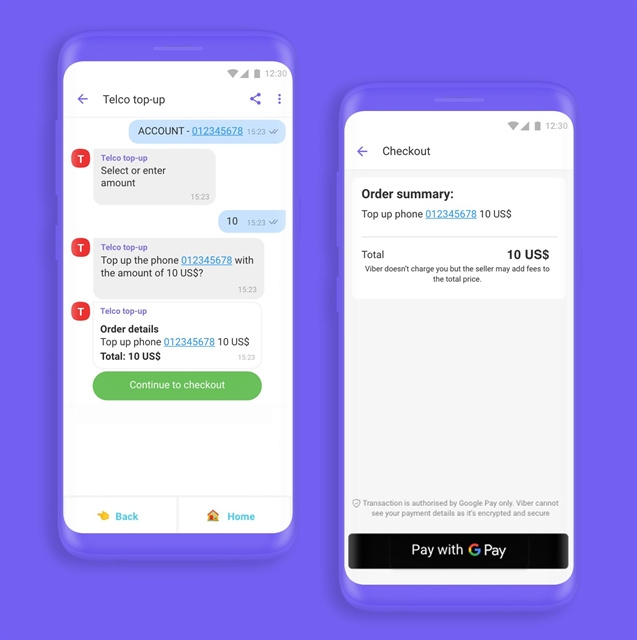

Viber’s chatbot payment feature will enable users to purchase goods and merchants’ services securely and directly through their official chatbot. With the support of the user’s bank, the user will have access to credit or debit card pair payment options in their local smartphone wallet for any chatbot built into Viber’s local chatbot application programming interface (API).

Anyone wishing to accept payments on behalf of such merchants must connect to a payment service provider that supports such payments by creating a chatbot on Viber, and will be able to make payments.

Viber is moving towards financial technology, introducing payments through chatbots