SAN FRANCISCO: Advanced Micro Devices agreed to pay $35 billion in stock for Xilinx, a deal aimed at reshaping one of the computer chip industry’s pioneers.

AMD, known mainly as Intel’s longtime rival in microprocessors that power most computers, plans to use the acquisition to broaden its business into chips for markets like 5G wireless communications and automotive electronics. The transaction could also help AMD grab a bigger share of component sales for data centers and counter a prominent rival, Nvidia, which is also bulking up.

As reported on The New York Times, all-stock deal, announced on Tuesday along with AMD’s third-quarter financial results, would be close to the most valuable acquisition in the chip industry’s history. Those bragging rights are currently held by Nvidia for its proposed $40 billion deal for the British chip designer Arm, which was announced last month.

Chip makers have experienced several consolidation waves, driven by factors such as duplicate product lines and cost-cutting strategies. But AMD, which is enjoying some of the most robust sales in its 51-year history, expects Xilinx to expand its business while increasing profits.

Lisa Su, AMD’s chief executive, said in prepared remarks that Xilinx would help establish her company as “the industry’s high-performance computing leader and partner of choice for the largest and most important technology companies in the world.”

That sort of reputation has long eluded AMD, which for decades was seen as an Intel follower that mainly won sales with lower prices. But the company has lately grabbed a lead over Intel in some key measures of computing performance, while its larger rival has suffered technological and financial stumbles, The New York Times reported

On Thursday, Intel reported a 29 percent decline in quarterly profits, which caused its stock to fall more than 10 percent. AMD, by contrast, reported on Tuesday that its quarterly profit had risen 148 percent.

AMD’s stock, which was trading five years ago at about $2 a share, has risen nearly 80 percent this year and closed Tuesday at $78.88, down 4 percent on the day. AMD’s market value stands now at nearly $100 billion.

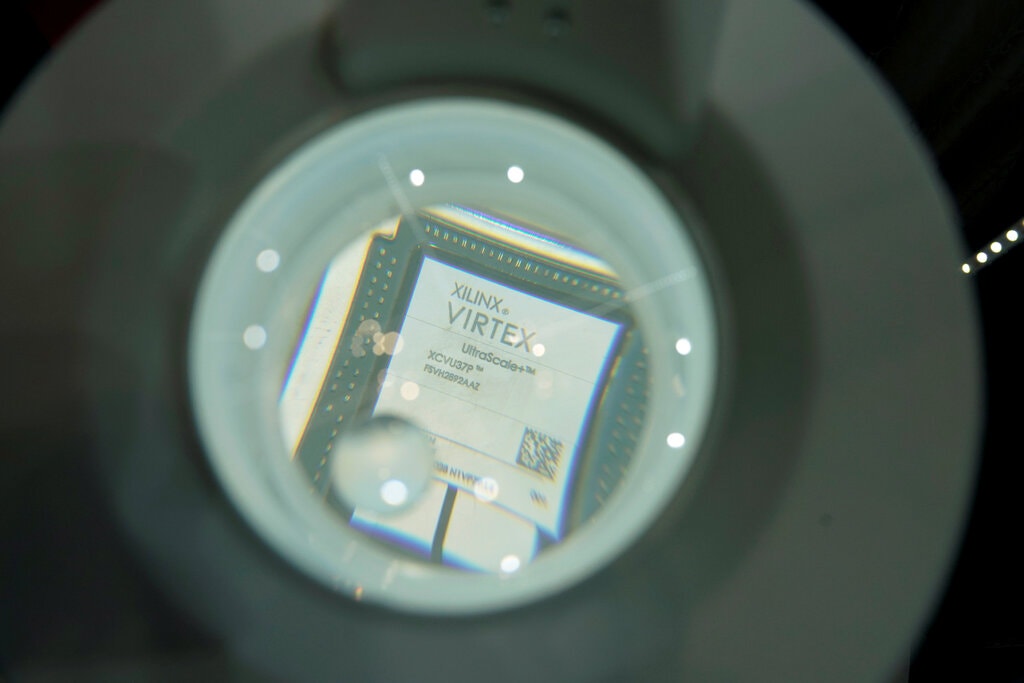

Xilinx, founded in 1984, is the biggest maker of a class of chips that can be reconfigured for a variety of specialized tasks after they leave the factory. Such field programmable gate arrays, as they are called, have long been particularly popular in telecommunications applications, such as cellular base stations now being upgraded for the latest 5G technology.

AMD Agrees to Buy Xilinx for $35 Billion in Stock