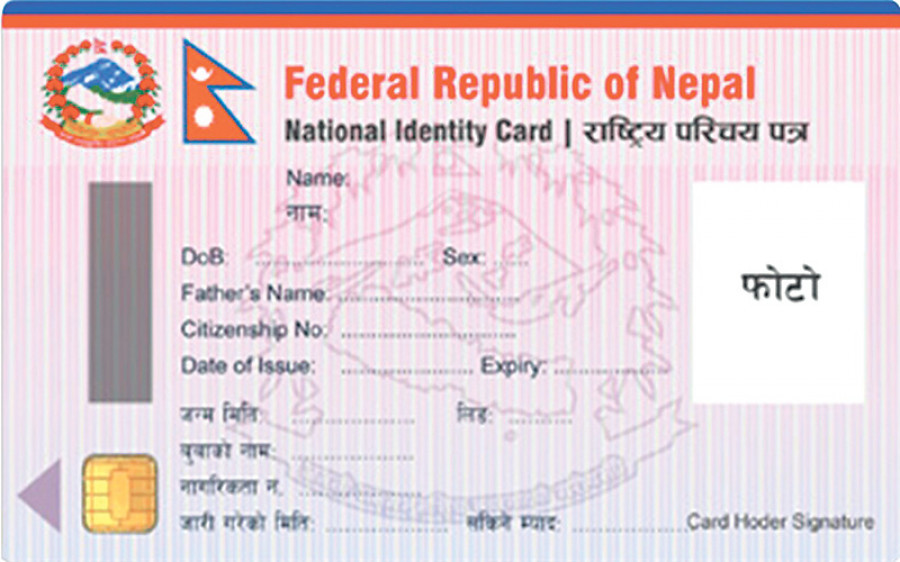

Kathmandu: Nepal Rastra Bank (NRB) has made the submission of a national identity card (National ID) mandatory for individuals wishing to open bank accounts, effective from January 14, 2025. This directive is part of an amended unified regulation aimed at enhancing financial security and customer verification processes.

According to a circular issued by NRB on Thursday, banks and financial institutions (BFIs) are now required to use the National ID or Nepali citizenship certificate details from the electronic record system when opening new accounts. The central bank has emphasized that BFIs may utilize electronic means to verify customers’ identities in line with existing regulations, ensuring compliance with anti-money laundering and fraud prevention standards.

However, the National ID requirement does not apply to individuals receiving payments under the government’s social security scheme. In such cases, while the ID is not necessary for account opening, BFIs must still verify the customer’s identity when funds are withdrawn.

NRB has also specified that BFIs must verify the authenticity of mobile numbers registered with bank accounts to confirm they belong to the account holder. Additionally, banks must monitor financial transactions linked to individuals, groups, or organizations flagged by the Ministry of Home Affairs. If any transactions involve suspicious entities, the accounts must be frozen, and the NRB’s Money Laundering Prevention Supervision Division must be notified within three days.

Furthermore, the NRB has instructed BFIs to maintain detailed records for government high-ranking officials and individuals linked to international organizations. These records should be preserved for up to 10 years after the officials’ retirement to track any post-retirement financial activity and associations. BFIs are also required to categorize customers based on their risk profiles, particularly those associated with corruption, tax evasion, human trafficking, and other illicit activities.

The central bank has emphasized that transactions involving high-risk individuals, including real estate traders, casino entrepreneurs, and cooperative accounts, should be closely monitored. Any suspicious transactions must be reported to NRB’s Financial Information Unit. Banks and financial institutions are also instructed to establish separate units to oversee and monitor such financial activities.